We Provide Long

Term Private

Capital For Fast

Changing World

We Provide Long

Term Private

Capital For Fast

Changing World

Dynamic

Family Office

Investment Group

We are a family office investment group driving strategic investments that create long-term value. Headquartered in the Czech Republic, we seek commodity-linked industrial opportunities in special situations that require restructuring or capital support across various industries and geographies. We combine fast decision-making, flexibility, and deep industry expertise. Our beneficiary is Pavel Tykač, a prominent Czech entrepreneur and investor.

Proven Expertise

We seek, value and nourish talent. Our team of more than 50 tenacious professionals across M&A, market analysis and business operations identify, execute, and integrate landmark acquisitions with a global reach.

We combine operational focus with disciplined risk and liquidity management across our portfolio.

People are our key assets. Across our global network of offices, we provide in-house expertise to run and improve operations and scale businesses for the long-term.

Diverse Portfolio

Since 2018 within the Sev.en Group and, since 2021, under the Sev.en Global Investments umbrella, we have built a diversified portfolio combining stable power generation assets with strategic investments to steel, production, mining rights, and recourse mining and processing.

We actively seek opportunities also in oil and gas, and the fertilizer production. Our diversified portfolio supports stable performance despite short-term commodity price volatility.

Our operations span American, Australian and European continents, while we are open to explore investment opportunities also in other regions. We run assets to the highest safety standards, complying with legal, social and environmental requirements in every country we operate in.

Astute Approach

Committed to long-term investing, we deploy our private capital into higher risk opportunities offering risk-adjusted returns.

We often find opportunities in areas where institutional investors reduce their exposure or face ESG constraints, yet these areas remain vital to our economies.

As a responsible owner and a reliable partner, we combine fast decision-making, flexibility, and deep industry expertise to create value for communities, governments, and other stakeholders.

Our businesses operate independently under their own management teams. We provide support where it adds value and share expertise across the group where relevant.

We bridge today’s industrial needs with tomorrow’s solutions.

We build strong and resilient businesses ready for future challenges.

By deploying capital with a long-term vision, we focus on fostering sustainable growth, driving operational efficiency, and enhancing business resilience. Our approach balances strong internal funding with a disciplined strategy toward risk and liquidity management, ensuring that the businesses we invest in are well positioned for future success.

"In 2025, Sev.en Global Investments took a major step forward by entering steelmaking industry and expanding into a new region, the Nordics. Through 7 Steel UK and 7 Steel Nordic, we acquired European leaders in low-carbon steel production showcasing the sustainability in the steel industry.

In Australia, SO4 delivered a breakthrough year. As the country’s only producer of premium organic fertilizer, the team moved from development to commercial execution and launched export shipments to Mexico, Peru, Spain, Ecuador, and Chile.

Also in Australia, Delta, owner and operator of the Vales Point Power Station in NSW, partnered with Samsung to explore a large-scale battery project, designed to strengthen the grid, improve reliability, and help manage supply volatility as renewables expand.

From power generation and resources mining to steelmaking, our progress depends on capable teams and strong execution. I am grateful for the professionalism and relentless drive for value our teams bring every day."

Alan Svoboda

CEO Sev.en Global Investments

€ 1,9 bn

value of total assets

5,880 MW

total installed generation capacity1

3

presence on three continents

5,500+

total employees

50+

professionals in Sev.en GI offices

2.2 m tons

steel components manufactured per annum

10+ m tons

coal mined per annum

2.2 bn tons

control over proven reserves of metallurgical and thermal coal

Global Reach

Across Industries

We deploy private capital across Europe, North America, and Australia, while we are open to explore investment opportunities also in other regions. We focus primarily on stable economies with predictable fundamentals and policies.

Our portfolio combines strategic investments in power generation, steel production, mining rights, and resources mining and processing.

With relentless appetite, we look also into oil and gas, fertilizer and other commodity linked industries as well.

Strong Credentials

We move fast and execute efficiently. We acquire and build businesses to create a resilient portfolio designed for long-term growth.

We move fast and execute efficiently. We acquire and build businesses to create a resilient portfolio designed for long-term growth.

In power generation, we provide energy security and reliability today while supporting a responsible transition. We are committed to support balance in the future of renewables, with carbon-intensive generation serving as a controlled, reliable backup to ensure continuous energy security.

In power generation, we provide energy security and reliability today while supporting a responsible transition. We are committed to support balance in the future of renewables, with carbon-intensive generation serving as a controlled, reliable backup to ensure continuous energy security.

In resources mining and processing, we are a responsible partner in critical resources, delivering high quality primary materials. We are reliable operator, prioritizing safety, efficiency, and highest environmental and reclamation standards.

In resources mining and processing, we are a responsible partner in critical resources, delivering high quality primary materials. We are reliable operator, prioritizing safety, efficiency, and highest environmental and reclamation standards.

In green industries, we invest in projects that move value chains forward, combining sustainability and future ready industrial practices.

In green industries, we invest in projects that move value chains forward, combining sustainability and future ready industrial practices.

Long-term

Commitment

Long-term approach shapes everything we do. We focus on steady operations rather than quick flips. Working with local management teams, we build on long-standing cooperation and look for practical synergies across our group.

We protect and create employment in the respective regions, acting fairly and valuing loyalty in enduring relationships with employees, communities, and all local stakeholders.

Delivering strategic commodities, we are a reliable partner to local governments and businesses.

Enduring Financial Power

We are a long-term, reinvestment driven owner focused on building sustainable value rather than short term dividend extraction. Our typical equity investment ticket is EUR up to 1bn, our private funds allow us to deploy capital quickly and efficiently.

We have the capacity to deploy significant capex to enhance asset performance. Internally generated cash flows are reinvested to grow and develop our existing businesses.

We maintain a conservative and balanced capital structure, with limited leverage at the holding level. External financing is structured primarily at the asset level, aligned with the specific needs and cash flows of each business.

We actively manage liquidity and liquidity risks across the portfolio, with a disciplined approach to risk oversight and operational delivery in industrial assets.

Family Office

Main Vehicle For

International

Growth

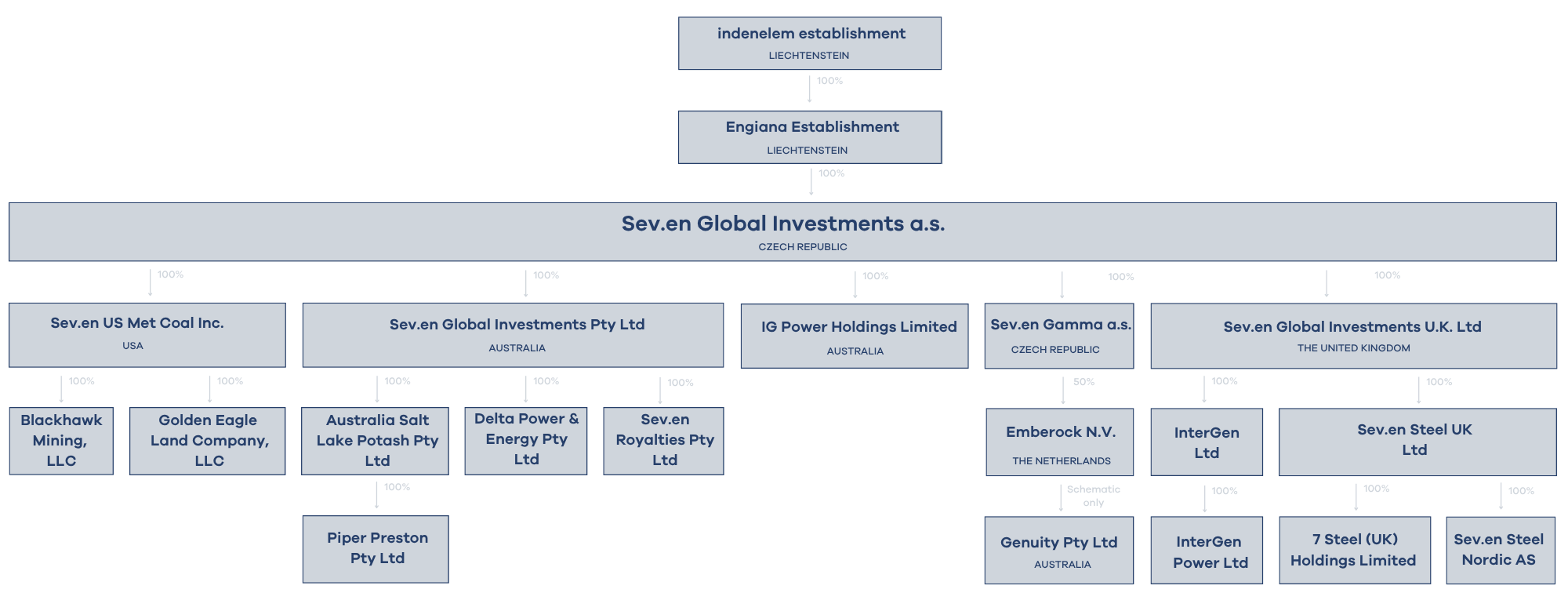

International expansion of Sev.en started in 2019 with the first major step being a purchase of the 50% interest in InterGen N.V. with assets in the UK and Australia.

In 2020, we continued with acquisitions of metallurgical coal producers in the United States including Blackhawk Mining and Corsa Coal Corp.

In 2021, the group acquired several portfolios of mining rights and land in the United States under the umbrella of Golden Eagle Land Company, which triggered a separate investment category focus.

Over the last three years these international acquisitions were consolidated under the Sev.en Global Investments group with the objective to further strengthen the investment focus and widen the acquisition scope to other sectors and regions.

At the end of 2021, Sev.en Global Investments became the family office main vehicle for international investments and business development.

In 2022, Sev.en Global Investments strengthened its energy generation business in Australia by acquiring a 100% share of Delta Electricity which owns and operates the coal-fired Vales Point Power Station and the Chain Valley Colliery mining complex in New South Wales.

In addition, Sev.en GI has expanded its sector presence to minerals by acquiring a 100% share in Australia Salt Lake Potash, the operating subsidiary of Salt Lake Potash (SO4), developing the flagship Lake Way potash project in Western Australia with planned production of over 200,000 tons per annum of potassium-based fertilizers.

In 2023, we have successfully divested our investment in InterGen UK assets and have further expanded our portfolios of land and mineral mining rights both in the United States (Golden Eagle Land Company) and in Australia (Sev.en Royalties).

And we also welcomed one of the largest independent power producers in the United Kingdom to our portfolio. We managed to complete the transaction of a 100% stake in InterGen UK, which operates four gas-fired power plants.

* Simplified structure, key operating companies only

Sean Neely

Director - UK Office

e-mail

Sean has spent over 30 years in M&A and development in the international power sector. He has led successful acquisitions across UK, Europe, Asia and Australia, including thermal power plants, wind and pumped storage. His expertise includes project development, M&A and financing. Sean is a Fellow of the Institute of Chartered Accountants, and he holds a BSc in mechanical engineering from Imperial College, London.

Mark Sykes

Country Manager – Australia

e-mail

Mark oversees Sev.en GI's investments in Australia. He has 30 years of experience in the natural resources and FMCG sectors. Mark has strong corporate experience including strategy, project management, optimisation of asset portfolios, mergers and acquisitions and technical engineering. Mark has both Australian and International business experience. He holds Mining Engineering degree from Curtin University and a Minerals Economic masters from Macquarie University in Australia.

Pavel Tykač

“Sufficiency of reliable, safe and affordable electricity is one of the basic conditions for the existence of today’s civilization.“

Mr. Pavel Tykač is a prominent Czech entrepreneur and investor, who has been ranked by Forbes Real Time Billionaires among TOP 400 World’s wealthiest people.

He has over thirty years of experience as entrepreneur and investor in various industries including computer technology, financing, banking and above all, energy and mining.

As a beneficiary of the Sev.en group he develops and expands his investments in the Czech Republic, and worldwide where the Sev.en group makes over 80% of revenues.

In 2006, he entered the mining sector via the acquisition of a minority interest in the Czech Coal mining group which, among other, owns the Vršany and ČSA lignite mines. Further energy investments followed including lignite fired power plant Elektrárna Chvaletice (2013), Teplárna Kladno and Teplárna Zlín (2019) and Elektrárna Počerady (2020).

Currently, Sev.en is a leading private energy group in the Czech Republic. Mr. Tykač is also a successful investor in other sectors including commodities, stocks, real estate and other.

The Tykač family supports various educational projects from Bohemian studies at Oxford University to Czech CEVRO University. Locally the family supports women, children, and families in need via a Women for Women Foundation.

Cummulatively, Sev.en group and the Tykač family donated recently over EUR 2,000,000 to charitable projects. In 2022, Sev.en and the Tykač family pledged a CZK 100 million (USD 5 million) donation to Ukraine under “The Bridge for Ukraine” initiative. This includes a number of integration and social projects for the affected families both in Ukraine and the Czech Republic. The project also aims to mitigate the energy impacts of this armed conflict.

In 2024 Pavel Tykač became the owner of the football club SK Slavia Prague.

We Build on 150 Years of History and Success of Sister Group Sev.en Česká energie

Business Areas

Mining

In Mining, Sev.en Česká energie operates the biggest lignite deposit in the Czech Republic – the ČSA mine, and the Vršany mine, with the longest life of lignite deposits within the existing territorial limits and total annual production almost 12 million tons and 2,149 employees.

Power and

Heat Generation

In the Czech Republic Sev.en Česká energie is the largest privately owned power generation group. Sev.en operates mostly lignite fired power plants with installed capacity of 4 x 205 MW at Elektrárna Chvaletice, 5 x 205 MW at Elektrárna Počerady and 6 production blocks in Teplárna Kladno (out of which 2 are natural gas blocks) & Zlín with the capacity of 588 MW electricity and 1 339 MW of heat.

In 2022 the group produced 11.7 TWh of electricity and over 617 GWh of heat.

Power

Engineering

Sev.en has a strong asset management expertise in energy generation and mining. Sev.en Engineering focuses on modernisation and optimal technical development of operated assets, provides technical audits of power plants and shares its experience with Sev.en Global Investments in technical evaluation and integration of acquired international energy and mining assets.

Land

Restoration

Sev.en Česká energie is an industry leader in land reclamation and recultivation. The group invested over 11 m EUR towards land reclamation activities. Our Green Mine project focuses on a transition of the ČSA mine region post-mining and includes new landscapes, new business activities or emission-free energy (PV plants, hydrogen) – a new life for the region and people who live there.